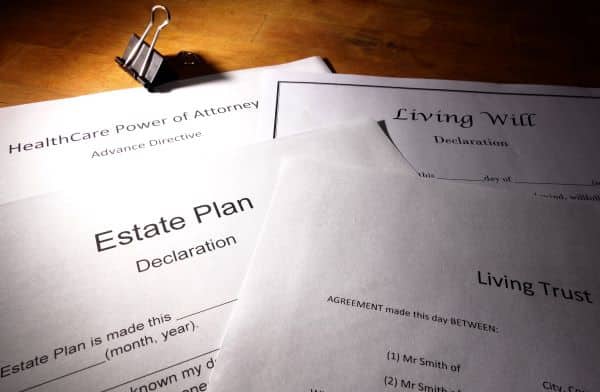

The Gift of Proper End-of-Life Planning Begins With You

In most cases, talking about the end of our lives is uncomfortable and easily avoided. Since we don’t want to talk about it, many of us don’t make plans for what we want to happen before or after we pass…