AARP reports that Baby Boomers are the generation with the highest divorce rates. Divorce among older adults in the United States has been on the rise since 1990. By 2019, 36 percent of divorces involved people 50 and older.

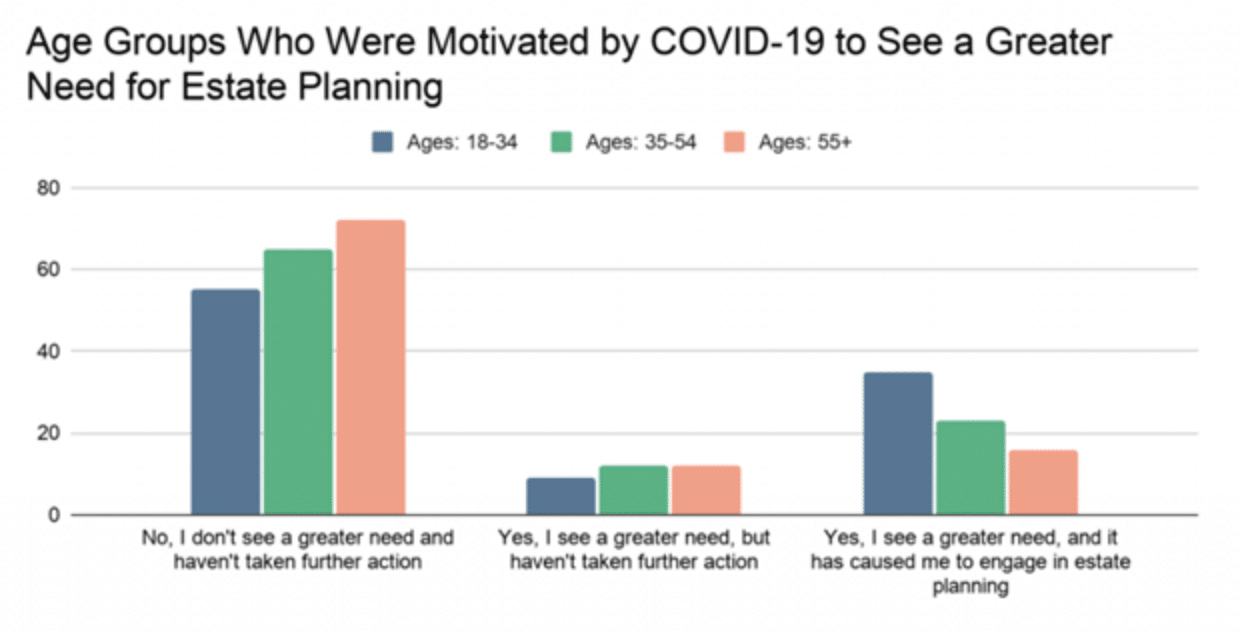

During the past year, the number of Americans with a will has only increased by 2.5 percent, according to a survey by Caring.com. Globally, the percentage of individuals with a will continues to decline, falling from 42 percent in 2017 to 33 percent in 2021. With the COVID-19 pandemic, one out of three people realizes the greater need for a will. However, 31 percent of those who do acknowledge the need do nothing about it.

Spikes in new cases of the coronavirus despite vaccination efforts, re-infections of vaccinated individuals, and increasing cases in younger, healthier people indicates COVID-19 challenges will plague the US and world populations for some time to come. If for no other reason, a pandemic should motivate you to create your will. Counterintuitive to the statistics, younger adults are more likely to follow through with a will creation than middle-aged and older adults.

Aside from procrastination as a reason for not having a will, Americans increasingly cite a lack of understanding about obtaining a will and do not know that attorney groups can create legal documents remotely. An attorney can help you develop as complex or straightforward a will and estate plan as your circumstances warrant without setting foot in their office space if need be.

Almost everyone has something of financial or emotional value they would like specific relatives or friends to inherit from them. A will acts as your voice after you are gone, ensuring your wishes are carried out. A valid and enforceable will significantly benefits your family, allowing you to protect a spouse and children. Your will designates who inherits your real property like a home or land you own and personal property like bank accounts, securities, jewelry, etc.

Besides determining how your property is distributed, a will can designate who will care for your minor children after you die. Without a will, the courts decide who cares for your children and their interests. Appointing a caretaker that you trust in your will affords you time to discuss how best to handle your children’s mental, emotional, and financial life preparedness.

Having a will allows you the option to disinherit individuals such as an estranged relative. In the absence of a will, the state will determine who inherits assets that may end up in the hands of someone you do not wish to receive your property. This intestate (dying without a will) distribution of your property varies by state and may not provide for the distribution you prefer. The absence of a will or other estate planning documents, like a living trust, can also lead to family strife.

Caring.com finds most Americans believe that at age 35, you should have a will in place, yet most Americans do not. Though many have started contemplating a will, most get no further than casual conversations with loved ones. Surprisingly the survey finds that 58 percent of respondents who don’t have a will say they do not think about or plan for it.

As the primary document for transferring your assets upon your death, your will is an essential part of your estate plan. As the COVID-19 virus continues to challenge all people’s health and well-being, it is reasonable and responsible to create a plan to preserve for your heirs what it took your lifetime to achieve.

We can help you determine whether a will is right for you, and we can help draft additional supporting documents, like healthcare directives, to support your overall plan and make sure your wishes are carried out. If you would like to discuss ways we can help, please contact our office at (352) 565-7737. Conversations are complimentary.